It has become the norm to increase insurance cover for community schemes by 10%, or even 15%, per year.

On the other hand, some bodies corporate choose not to increase cover at all. However, how often do bodies corporate consider decreasing cover?

Yes, there are situations where bodies corporate need to decrease their cover!

This may sound irrational, but the reality is that we often encounter buildings that are significantly over-insured, resulting in wasted insurance premiums. That can add up to thousands of Rands over a few months in some cases.

If a sectional title scheme has habitually increased their cover by 10% every year, construction costs not increasing by the same proportion, such a scheme can easily find themselves over-insured by as much as 50% after just five years. This means it will be paying an inflated insurance premium every month but not receiving any additional benefits, and the longer this carries on, the more money is being wasted.

The problem with annual escalation rates

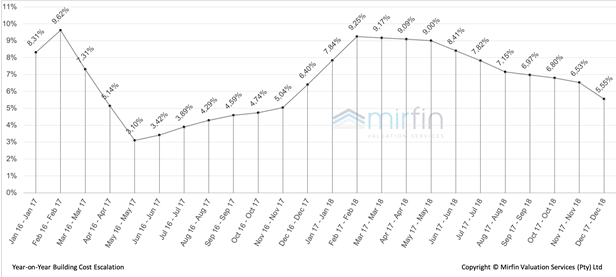

The graph below illustrates the actual (for 2016-17 and 2017-18) escalation rates in South Africa.

Let’s look at an example: If your policy renewal was in February 2017, you might have considered a 9.62% escalation but three months later (May 2017), you would have applied 3.10% to your policy renewal.

Year-on-Year Building Cost Escalation

As you can see, it’s not a good idea to work on annual averages as the monthly year-on-year deviation can be quite erratic.

The problem with escalating by a flat rate of 10% annually

As is also evident from the graph above, an annual escalation by a flat rate of 10% is not to the insured’s advantage. Before Covid-19, economic commentators even predicted that building costs would escalate by 13 – 14% for the next 2 years to come!

Let’s use the following practical example to explore the effect of escalating the sum insured by a flat rate of 10% or 15% annually, and let’s assume, for the sake of this example, that the building in question was insured for R80 million in September 2016:

As you can see, after only three years, a flat increase of 10% would have led to being over-insured by 13.49% or R12 658 159 (yes, R12 million!). Alarmingly, an increase of 15% over three years would have led to being 29.68% over-insured, or almost R28 million.

The premium for an average building insured for R94 million vs R122 million (both rounded off) could result in wastage of R31,000 in annual premiums.

A professional valuation saves you money

Obtaining a professional valuation for less than R5,000 every three years will both save you from wasting significantly more money by over-escalating the sum insured and protect you against claims being averaged by your insurer.

Furthermore, Mirfin provides free annual valuation updates during the obligatory three-year valuation cycle, thus enabling trustees to take an informed decision when the body corporate’s insurance policy is up for renewal every year.

Cookies are necessary to operate this website. You may withdraw your consent to cookies at any time by selecting/setting your preferences on your user profile.

In order to proceed with using Mirfin's website, it is mandatory to accept cookies. You may withdraw your consent to cookies at any time by setting your preferences on your user profile.