Objecting to municipal rates refers to the process where residents formally dispute or challenge the charges imposed by their municipality for property rates, services, and other related fees.

This objection typically involves submitting a formal complaint or objection to the municipality, citing specific reasons or grounds for disputing the rates. The aim is to seek a fair review or resolution of billing errors, incorrect assessments, or any other valid reasons for disagreement with the rates imposed by the local authority.

Below are some of the frequently asked questions we receive regarding municipal rates objections.

Should you have questions, email us at info@mirfin.co.za and let’s explore the best approach for your unique situation.

Contents Valuations: What you need to know

As a property owner in South Africa, you have the legal right to object to your municipal rates. The grounds for objecting to property valuation are delineated in the Municipal Property Rates Act N6 of 2004 (with subsequent amendments), specifically outlined in sections 48 to 56.

For detailed information on the objection process, you can check out our dedicated post "Municipal rates objection steps".

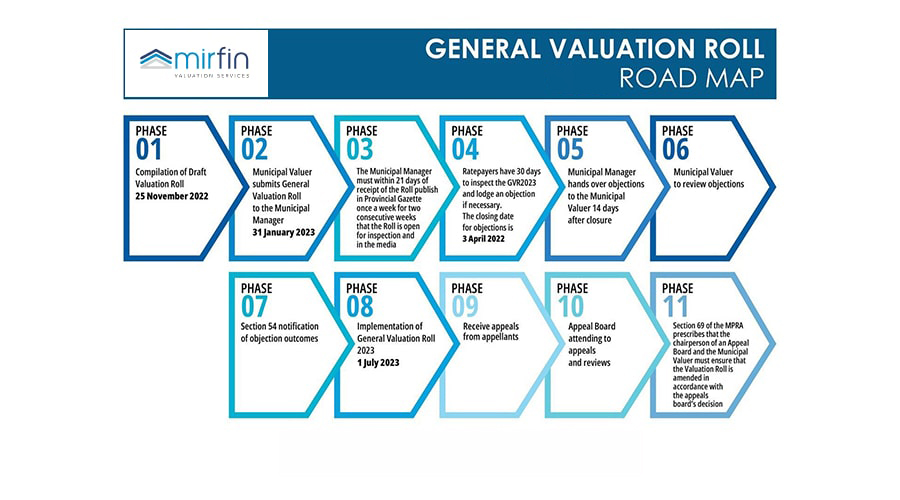

- You lodge an objection with the municipal manager against any matter reflected in the municipal property valuation roll in relation to your individual property. It is supposed that prior to lodging the objection you had requested the municipality to make extracts from the roll so that your objection would be grounded.

- After you lodged an objection, a municipal valuer must promptly consider the objection and any decisions regarding your property were taken, adjust or add to the valuation roll in accordance with those decisions; and, in writing, notify you about the the decision taken.

- In case you’re not satisfied with the decision the notification informs you about, within 30 days after the notification was issued, you may apply to the municipal manager for the reasons for the decision.

- A municipal manager must forward your appeal to the chairperson of an appeal board, who must convene a meeting of the appeal board within 60 days to review decisions of a municipal valuer. Meetings of an appeal board are open to the public, but the board may adjourn in a closed session when deliberating an issue before the board.

This is how the process goes in general.

Getting a market valuation from a reputable valuation company can significantly strengthen a property owner's case during an objection or appeal process. A professional valuation report carries weight as credible evidence, providing an alternative property valuation that could support claims of overvaluation or incorrect assessments by the municipality.

Yes, Mirfin can assist with independent and objective market price valuations that are steadfast to the scrutiny of the authorities.

Generally, a basic valuation for objection purposes in South Africa ranges from R2,500 to R3,500, depending on the property's complexity and size. While the cost may seem steep, it can be a worthwhile investment. A successful objection leading to a reduced property value can lead to significant long-term savings on your property rates.

For example, a drop of R200,000 from R700,000 to R500,000 could translate to an average annual saving of R1,700 on property taxes. This could recoup the valuation cost within a few years. For larger reductions of R3,000 or R5,000, the payback period shrinks to one year or even less.

The decision of whether to obtain a professional valuation depends on your specific circumstances and the potential for a significant reduction in your property value. If you suspect only a slight overvaluation of your property, ordering its valuation migtht not be your first choice.

In this case consider first negotiating directly with the municipality before purchasing a professional property valuation report or initiating the formal objection process. This can sometimes lead to a reduced valuation without incurring the cost of a professional valuation.

However, if you strongly believe that your property is significantly overvalued, opting for a valuation is highly recommended. The potential long-term savings on rates significantly outweigh the initial cost, particularly for higher-value properties.

Read more;

Know how your property rates are calculated in South Africa

It's important to note that while a successful objection can result in a reduced property value, there's no absolute guarantee that your rates will decrease after an objection. The decision ultimately lies within the framework of the municipality's review process and the evidence presented during the objection.

As we noted earlier, the process involves various stages delineated in the Municipal Property Rates Act N6 of 2004 (with subsequent amendments). The act outlines not only the grounds for objecting to property valuations and the subsequent steps that property owners need to take when disputing their municipal rates, but also it prescribes the obligations and rights of a municipal manager, municipal valuer and the appeal commission members.

A successful objection typically occurs when substantial evidence supports the claim of overvaluation. This can involve showcasing comparable properties with lower valuations, highlighting incorrect assessments, or presenting factual data indicating a disparity between your property's valuation and similar ones in the area. A professional market price valuation report can serve as such factual data.

However, there are instances where, despite compelling evidence, the municipality may not adjust the property value. They consider various factors, and their decision may depend on the evidence presented and the prevailing valuation standards.

While municipal rates objection is a legal right aimed at rectifying overvaluations, its success is contingent upon the municipality's evaluation process and the strength of the evidence presented during the objection.

While there is no fixed deadline for objecting to municipal rates, section 49 of the Municipal Property Rates Act (MPRA) stipulates that the roll is open for public inspection for a period, which may not be less than 30 days after the roll is published in the provincial Gazette.

Your municipality may choose to extend this period, so be sure to contact your local office for the exact date by which objections must be submitted. Don't wait until the last minute – the sooner you file your objection, the sooner it can be reviewed.

The process of lodging an objection to municipal rates is prescribed by the Municipal Property Rates Act (MPRA). While the Act and its amendments don't explicitly require objectors to submit evidence with their objection, it's important to consider several points.

Firstly, section 79 of the MPRA stipulates that individuals may be summoned to provide evidence or produce specific documents. While not mandatory, it's highly likely you'll be asked to provide supporting evidence if your objection goes to hearing.

Secondly, sections 72 and 73 grant appeal boards broad powers to gather information related to an objection. This includes the right to:

- Enter the property under appeal during business hours on weekdays (excluding Sundays and holidays).

- Inspect the property for the purpose of the appeal.

- Request access to any documents or information you possess that may be relevant to the appeal.

- Make copies of relevant documents or information.

- Require you to provide written details about the property as needed for the appeal.

While the MPRA doesn't explicitly force you to provide evidence, these sections effectively oblige you to cooperate with the municipal valuer or appeal board if they request information related to your objection.

Therefore, providing clear and relevant evidence to support your objection is strongly recommended. This will strengthen your case and increase your chances of a successful outcome.

While the Municipal Property Rates Act (MPRA) doesn't explicitly require a property inspection as part of the objection process, there are scenarios where it might happen.

Sections 72 and 73 of the MPRA give appeal boards the right to enter the property under appeal during business hours on weekdays (excluding Sundays and holidays) and request access to any documents or information you possess that may be relevant to the objection.

Therefore, your property could be inspected if:

- You file an objection that raises questions about the property's condition or features.

- The appeal board deems an inspection necessary to properly assess your objection.

Keep in mind that even if an inspection isn't explicitly requested, you're obliged to cooperate with the municipal valuer or authorized person if they need access to your property or relevant documents for the objection process.

It’s hard to give an exact sum because the amount you can save depends on how much your property is originally valued in the Roll and its adjusted value.

For example, a drop of R200,000 from R700,000 to R500,000 could translate to an average annual saving of R1,700 on property taxes. For larger reductions, your rates savings increase proportionally.

If you've received a written notification upholding the original valuation from the Valuation Roll Committee, don't feel powerless. The decision can be appealed through two routes:

- Internal Appeal:

As prescribed by Section 54 of the Municipal Property Rates Act (MPRA), you can request an internal review by the municipal Valuation Appeal Board. This body re-examines your case and the committee's decision, offering a chance to revise the valuation based on your arguments and evidence.

- Court Appeal:

If the internal appeal doesn't yield the desired outcome, you can take your case to the regional High Court. This route requires legal representation and involves a court hearing, making it a more complex and resource-intensive option.

Before embarking on an appeal, carefully evaluate your case. Have you gathered stronger evidence or arguments since the initial objection? Consider consulting professional valuers like Mirfin who can provide a robust market price valuation to bolster your appeal and increase your chances of success.

Mirfin's comprehensive municipal rates check services can save you time, money, and stress throughout the process.

Read more Municipal rates check

If you feel your property isn't comparable to others in your area in South Africa, the Municipal Property Rates Act (MPRA) gives you the right to object your property Roll value under Section 50.

Here's why you might have good grounds for an objection:

Unique features.

Does your property have unique features like historical significance, a large garden, or specific amenities not found in comparable properties? These factors can impact your property's value and might not be adequately reflected in a standard valuation.

Zoning or restrictions.

Are there zoning restrictions or development limitations on your property that influence its potential value compared to seemingly similar properties?

Recent upgrades or renovations.

Have you invested in significant renovations or upgrades that enhance the property's value but haven't been factored into the valuation?

Market changes.

Has the local property market experienced significant shifts affecting your property's value differently than those used for comparison?

Mirfin’s market rates check offering can help you to strengthen your objection. We can help you gather evidence, such as assess your property and prepare a professional valuation report supporting your case.

Focusing on your property's specific differences, the market price report clearly explains to the municipal committee why the chosen comparable properties are not truly comparable to yours due to unique features, limitations, or market factors.

There are a number of options you can choose among to know how much a property can cost on the market.

If you're interested in learning all of them, our in-depth article "How can I determine the value of my property?" provides a valuable starting point and step-by-step instructions.

It makes sense to point out that the market value is not an exact science, and various methods may yield slightly different results. However, for the most accurate assessment, especially when dealing with a municipal property rates objection, seeking the expertise of a professional property valuer is recommended.

Consider getting a quote from our professional valuer today!

Get a quote

If you'd like to utilize property sales prices in your location as evidence to object to your municipal rates, the most reliable source of information would likely be the Deeds Registry, maintained by the Department of Land Affairs and Rural Development. The Deeds Registry serves as a centralized repository for property ownership records, providing valuable insights into recent sales transactions. This is the first spot you should visit to check if there were recent property sales in your area.

You can access the Deeds Registry electronically through Deedsweb, a dedicated website offering a comprehensive search interface for property information.

While property sales statistics can be employed as evidence for a municipal rates objection, it's crucial to recognize several potential drawbacks to consider.

Firstly, property sales data may be incomplete or outdated, especially if it relies solely on public property records or online platforms. Inaccurate comparisons with your property's actual value could result from such limitations in data availability.

Secondly, not all properties that have recently sold in your area will be directly comparable to yours. Unique features, such as renovations, upgrades, property size, and overall condition, can significantly impact a property's value. Comparing your property to dissimilar properties may yield inaccurate valuation results.

Moreover, the value of your property may have changed since the comparable sales took place. If the comparable sales are too old, they may not accurately reflect the current market conditions and your property's true value.

When considering utilizing property sales statistics to challenge your municipal rates valuation, it's essential to carefully evaluate these limitations and potential drawbacks. Consulting with a qualified real estate appraiser or an experienced attorney can assist you in gathering and presenting accurate and persuasive evidence to support your objection.

Let Mirfin’s team of property valuation experts handle the complexities of municipal rates objections, ensuring you pay the fairest possible value for your property.

Check our offering on the Municipal rates check page

Or get a free quote right away

This is a quite common question we already answered a number of times on our site. To not repeat ourselves you can check the answer on this question here.

Read more:

There is no one answer to this question, as it depends on various factors.

One of them is your personal preferences. If you value accuracy, fairness, and justice more than convenience, cost, and risk, you may object to a property valuation that you consider incorrect or unfair. However, you may also prefer to avoid conflict, hassle, and uncertainty and accept the valuation as it is. Ultimately, you have to weigh the pros and cons of objecting to a property valuation and decide what is best for you.

Another factor to consider is the cost of objecting to a property valuation. If your primary goal is to save on taxes, you should keep in mind that the objection process itself involves certain costs, which may vary depending on the method and the complexity of the case. You may choose to object on your own, using the prescribed forms and supporting documents available on the municipal website. Or you may opt to hire a professional valuer or a lawyer to assist you with the objection process.

Thus if your primary goal is to save on taxes but you also anticipate that the costs will exceed the amount you save on taxes, there is no obvious reason to object to the valuation. In conclusion, objecting to a property valuation, even if the difference is small, is a personal and financial decision that requires careful consideration of various factors. You should evaluate your own preferences, goals, and resources before making a final choice.

If you want to have a good market price valuation report for your property, contact us today get a free quote from our professional valuers.

The answer is: it depends. According to the Property Rates Act 6 of 2004, the municipal valuer must consider your objection and make a decision within a reasonable time. The municipal valuer must provide you with a written decision, and you can request written reasons within 30 days.

If the municipal valuer adjusts the value of your property by more than 10%, the objection will automatically be submitted to the Valuation Appeal Board for a compulsory review. The Valuation Appeal Board is an independent body that hears appeals against the decisions of the municipal valuer. The board will notify you of the date, time and place of the hearing, and you will have the opportunity to present your case and evidence, and to cross-examine the municipal valuer.

If the municipal valuer does not adjust the value of your property by more than 10%, you can still appeal to the Valuation Appeal Board if you are not satisfied with the decision. You must lodge your appeal within 21 days of receiving the written decision or reasons, and pay the prescribed fee. The board will then schedule a hearing and inform you accordingly.

Therefore, you will only need to attend a hearing if you object and either the municipal valuer adjusts the value by more than 10%, or you appeal to the Valuation Appeal Board.

If you need more information or assistance, please submit a free quotation request. Mirfin’s professional property valuers can help you with all your valuation needs. You can also reach us by phone, email, or through our website.

If you have lodged an objection to the valuation of your property by the municipality, you may not be satisfied with the decision of the municipal valuer. In that case, you have the right to appeal to the Valuation Appeal Board, an independent body that hears appeals against the decisions of the municipal valuer.

However, appealing to the Valuation Appeal Board is not free. You will have to pay a prescribed fee, which is determined by the Minister of Finance. The fee is based on the value of your property and the amount of your appeal. The fee is refundable if your appeal is successful, or if the board decides to waive the fee in exceptional circumstances.

According to the Property Rates Act 6 of 2004, the fee structure for appealing to the Valuation Appeal Board is as follows:

Value of property | Amount of appeal | Fee |

R0 - R500 000 | Any amount | R100 |

R500 001 - R1 000 000 | Up to R100 000 | R250 |

R500 001 - R1 000 000 | More than R100 000 | R500 |

R1 000 001 - R5 000 000 | Up to R200 000 | R500 |

R1 000 001 - R5 000 000 | More than R200 000 | R1 000 |

R5 000 001 - R10 000 000 | Up to R500 000 | R1 000 |

R5 000 001 - R10 000 000 | More than R500 000 | R2 000 |

More than R10 000 000 | Any amount | R4 000 |

Therefore, the fees involved if you appeal an unsuccessful objection depend on the value of your property and the amount of your appeal.

You can find more information about the appeal process and the fee structure in this post.

We hope this answer helps you with your appeal process. If you need more information or assistance, please do not hesitate to contact our company at any time. We have extensive experience and expertise in property valuation in South Africa, and we can offer you the best service and advice.

Mirfin is a nationwide property valuation company. Our services range from home contents valuation to comprehensive sectional title insurance valuations. So, when it comes to municipal rates, our services are limited to providing a comprehensive and professional residential and commercial property market price valuation services.

Objecting municipal rates is a complex procedure that often requires a lawyer’s participation. We can connect you with our trusted partners who can assist you with the legal aspects of your property tax appeal, no matter what your property is located in.

Send us a request for a free quotation to learn more.

The entire objection process can take anywhere from a few months to over a year, depending on the circumstances of your case, and this is why.

If you disagree with the valuation of your property by the municipality, you have the right to lodge an objection within 30 days of the publication of the valuation roll.

According to the Property Rates Act 6 of 2004, the municipal valuer must consider your objection and make a decision within a reasonable time. The municipal valuer must provide you with a written decision, and you can request written reasons within 30 days.

Then, if you are not satisfied with the decision of the municipal valuer, you can appeal to the Valuation Appeal Board, an independent body that hears appeals against the decisions of the municipal valuer. You must lodge your appeal within 21 days of receiving the written decision or reasons, and pay the prescribed fee. The board will then schedule a hearing and inform you accordingly.

The board must notify you of its decision within 14 days of the hearing. The duration of the hearing and the decision of the board depend on various factors, such as the complexity of the case, the availability of the board members, and the number of appeals.

The board’s decision is final and binding, unless it is reviewed and set aside by a court of law. If you are unhappy with the board’s decision, you can apply to the High Court for a judicial review within 180 days of receiving the decision. However, this is a costly and lengthy process, and you will need to have strong grounds to challenge the board’s decision.

Alternatively, you can accept the board’s decision and pay the property rates according to the valuation determined by the board. You can also apply for a rates rebate or exemption if you qualify for any of the categories specified by the municipality, such as pensioners, indigents, or agricultural properties.

Therefore, the entire objection process can take anywhere from a few months to over a year, depending on the circumstances of your case, and the outcome may not be in your favour. That is why it is important to have a professional and reliable property valuation company to assist you with your objection and appeal process.

Sure. First of all, we recommend studying the Municipal Property Rates Act 2004 and its amendments, which provide the legal framework for the municipal rates system in South Africa. The act sets out the powers and duties of municipalities, property owners, and other stakeholders, and explains the procedures for objecting to the valuation of your property and appealing to the Valuation Appeal Board.

You can also visit our blog. There is a number of posts amining to assist you in dealing with municipal rates objection

- How to object to your municipal property valuation

- Property rates and taxes in South Africa

- Property valuation methods

In addition to the act and our blog, there are many other resources and materials that you can use to learn more about municipal rates objections. Here are some examples:

- The website of the Department of Cooperative Governance and Traditional Affairs, which provides information and guidance on the municipal rates system and the objection and appeal process.

- The website of the South African Property Owners Association, which offers advice and support to property owners and landlords, including information on municipal rates and taxes.

- The website of the South African Local Government Association, which represents the interests of municipalities and provides resources and training to municipal officials and councillors.

- The website of the South African Institute of Valuers, which is a professional body for valuers and provides education, training, and accreditation to its members.

We hope these resources will help you with your research and learning. If you need more information or assistance, please do not hesitate to send us a free request for quotation regarding your case. Mirfin Valuation Services has extensive experience and expertise in property valuation in South Africa, and we can offer you the best service and advice. You can find our contact details on our website.

Before starting the objection process:

- You should make sure that you have all the necessary documents and information before you lodge an objection, such as your property valuation notice, your municipal account, title deed, lease agreement and any other relevant documents. This will help you to make a strong and well-supported objection.

- You should also be aware that objecting to the valuation of your property may not always result in a lower valuation or lower rates. The municipal valuer may decide to increase the valuation of your property, or the Valuation Appeal Board may confirm the original valuation. Therefore, you should be prepared for all possible outcomes.

- You should also be aware that the objection and appeal process can be time-consuming, complex, and costly. You may need to hire a professional valuer or an attorney to assist you with your objection and appeal, which can add to your expenses. Therefore, you should carefully consider the costs and benefits of objecting to the valuation of your property.

We hope this page contains all the information you may need to know prior to getting to the objection and during it. Should you need more information or assistance, please contact us or send a free request for quotation right away.

What is Mirfin’s “Low-Price Guarantee”?

We pledge to beat any price for the same service offering. However, in the event of a reduced fee, Mirfin’s professional liability will be adjusted to that of its direct competitor.

But why put yourself personally at risk for the sake of saving the body corporate a few hundred rand?

Why choose Mirfin for your property valuation?

Best price guarantee

We will beat any price for the same service offering.

20 years

We are industry pioneers and industry leaders for over 20 years.

600 000 + clients

We’re a South African nationwide property valuation services provider for homeowners, property managers, insurers, brokers & attorneys.

One-click quotations

No time for filling in forms? Just click the button for an instant quote and share it with your clients.

98% service coverage

Our surveyors are situated in the densely populated areas of Johannesburg, Pretoria, Cape Town, Durban, Bloemfontein, Port Elizabeth, East London and Mossel Bay.

17% extra discount

Save on average 17% in premiums for your insurance broker with Mirfin’s property insurance valuation report .

Related posts

Municipal Rates Check

How to object to your municipal property valuation

If you believe the municipal valuer has over-valued your property, you should contest this; if justified, the valuer will be amended. If an objection is not lodged during the advertised objection period there is little prospect of having the municipal valuation amended, barring special circumstances.

Residential Property Valuations – All You Need to Know

Consider other Property valuation services we offer

Body Corporate Valuations

Trustees must obtain an insurance valuation of all common property structures and present it at the AGM at least every 3 years.

10-Year Maintenance Plan

Schedule your scheme’s maintenance activities and calculate the levies with the Mirfin Dashboard.

Residential Property Valuations

Ensure that your property is accurately valued on the market or insured for true replacement cost

Building Insurance Valuations

Did you know that your building’s insurance has nothing to do with the price you paid to purchase it?

Commercial Property Valuations

Different methods can be used to determine the value of a commercial property.

Municipal Rates Check

Has your property been over-valued by the municipality? Support your objection with a Mirfin valuation.

Content Valuations

Don’t fall short when replacing your moveable assets after a burglary, fire or flood – invest in a professional contents valuation.

Cookies are necessary to operate this website. You may withdraw your consent to cookies at any time by selecting/setting your preferences on your user profile.

In order to proceed with using Mirfin's website, it is mandatory to accept cookies. You may withdraw your consent to cookies at any time by setting your preferences on your user profile.