How does the Mirfin Dashboard simplify complex management? Insurance alerts: see which buildings are over- or underinsured. Live valuation updates: view your building’s current replacement value at any time. One-click quotations: get a Mirfin quote for your loaded buildings with a single click. Admin fund budgeting: use our online template to create and manage your […]

A contents valuation involves assessing the worth of personal possessions and belongings within a house or flat, encompassing items like furniture, electronics, jewelry, clothing, and other valuable assets. Its significance lies in ensuring accurate insurance coverage, aiding in financial planning, and providing essential documentation in case of loss, theft, or damage. A proper valuation enables […]

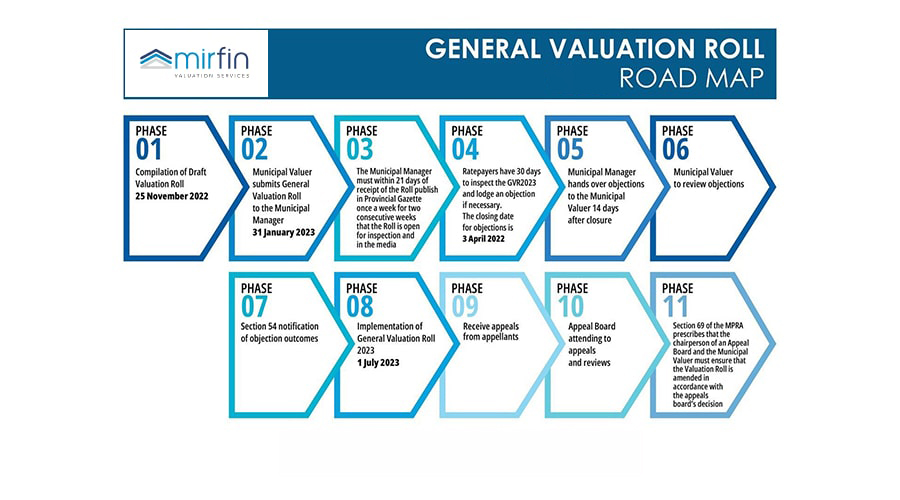

Objecting to municipal rates refers to the process where residents formally dispute or challenge the charges imposed by their municipality for property rates, services, and other related fees. This objection typically involves submitting a formal complaint or objection to the municipality, citing specific reasons or grounds for disputing the rates. The aim is to seek […]

Whether you manage a body corporate property, or you are a freehold property owner, or represent a business, you may be in need of a reliable property valuations company one day. Mirfin Valuation Services is a leading nationwide provider of property valuations, delivering accurate property valuation reports catering to bodies corporate, individuals, and corporate clients. […]

A commercial property valuation refers to the professional assessment conducted by qualified valuers to determine the market value of a commercial property. This valuation process considers numerous factors such as the property’s location, size, condition, income potential, comparable sales, rental income, expenses, and prevailing market trends. It aims to ascertain the worth of the property […]